Looking for ways to finance your dreams without breaking the bank? Examples of installment loans might just be what you need. These loans provide a structured repayment plan, allowing you to manage your finances more effectively. Whether you’re considering a new car, home renovations, or consolidating debt, understanding different types of installment loans can empower you to make informed decisions.

Overview of Installment Loans

Installment loans come in various forms, each designed for specific needs. Understanding these examples can help you choose the right option.

Personal loans are versatile and can cover anything from medical expenses to vacations. You typically repay them over a few months to several years, depending on the amount.

Auto loans specifically finance vehicle purchases. They often have shorter terms, ranging from three to seven years. Monthly payments depend on the car’s price and your credit score.

Mortgages enable homebuyers to purchase property without paying the full price upfront. These long-term loans usually span 15 to 30 years, making monthly payments more manageable.

Student loans assist with education expenses. Repayment terms vary widely but typically allow several months after graduation before payments begin.

Debt consolidation loans combine multiple debts into one payment, simplifying your financial management. This loan type often features lower interest rates than credit cards.

By exploring these examples of installment loans, you can determine which fits your financial situation best.

Common Examples of Installment Loans

Installment loans come in various forms, each catering to specific needs. Understanding these examples helps you choose the right option for your financial situation.

Personal Loans

Personal loans serve a broad range of purposes. They cover expenses like medical bills, vacations, or home improvements. Repayment terms typically span from three months to five years, allowing flexibility in budgeting. You can often secure them through banks or credit unions, and interest rates vary based on your credit score.

Auto Loans

Auto loans make purchasing vehicles easier. These loans usually have terms ranging from three to seven years, making car payments manageable within your budget. Lenders often offer lower interest rates since the vehicle serves as collateral, which reduces risk for lenders. Make sure you explore different financing options before committing.

Home Mortgages

Home mortgages are essential for buying property. Most mortgages are structured over 15 to 30 years, giving homeowners plenty of time to repay their loan amounts while enjoying their homes. Interest rates can be fixed or adjustable depending on market conditions and personal preferences. It’s important to understand all associated costs when considering a mortgage.

Student Loans

Student loans help finance education costs effectively. They typically offer deferred payment options until after graduation, easing immediate financial burdens for students. Federal student loans generally provide lower interest rates compared to private ones, along with flexible repayment plans tailored to income levels post-graduation. Investigate both types carefully to find what suits you best.

By knowing these examples of installment loans, you’ll be better prepared to make informed financial decisions that align with your goals and circumstances.

Benefits of Installment Loans

Installment loans offer several advantages that can make financial management easier for you. Understanding these benefits helps you see why they are a popular choice for many.

Predictable Payments

Predictable payments simplify budgeting. Since installment loans come with fixed monthly payments, you know exactly how much to set aside each month. This predictability allows you to avoid surprises and manage your finances more effectively. Additionally, knowing the total repayment amount upfront helps in planning your long-term financial goals.

Flexibility in Use

Flexibility in use makes installment loans appealing. You can allocate funds from personal loans for various purposes like home improvements or medical expenses. Auto loans specifically cater to vehicle purchases, while mortgages focus on property financing. Student loans cover educational costs extensively, making them an essential option for many students. By consolidating debts with specific consolidation loans, you streamline payments into one manageable monthly bill. This versatility ensures there’s an option that fits your needs perfectly.

Drawbacks of Installment Loans

While installment loans offer several advantages, they come with notable drawbacks. Understanding these can help you make informed financial decisions.

Interest Rates

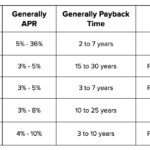

Interest rates on installment loans can be higher than other financing options. Depending on your credit score and the lender, interest rates may vary significantly. For example, personal loans might carry rates from 5% to 36%, while auto loans typically range from 3% to 15%. If you have poor credit, expect higher rates that increase overall repayment costs.

Commitment

Installment loans require long-term financial commitment. When you take out a loan, you’re agreeing to repay it over months or years. This commitment can strain your budget if unexpected expenses arise. For instance, failing to meet payment deadlines could lead to late fees and damage your credit score. Are you ready for this level of responsibility? Consider how an installment loan fits into your financial plan before proceeding.