Imagine navigating the complex world of finance without a trusted guide. That’s where an accountant steps in, ensuring your financial health and compliance with regulations. Whether you’re a small business owner or managing personal finances, having an accountant can make all the difference.

In this article, you’ll explore various roles and responsibilities of accountants that go beyond just crunching numbers. From tax preparation to financial planning and auditing, accountants play a crucial role in helping individuals and businesses thrive. Ever wondered how they transform intricate data into actionable insights? You’ll discover real-world examples showcasing their impact on decision-making and growth.

Get ready to dive into the fascinating world of accounting, where expertise meets strategy! Understanding what an accountant does could be your key to unlocking better financial management.

Overview of Accountant Role

Accountants play a crucial role in managing financial data and ensuring compliance with regulations. They provide valuable insights that drive informed decision-making for individuals and businesses alike.

Key Responsibilities

Accountants handle a range of tasks essential to maintaining financial health. Their key responsibilities include:

- Tax Preparation: Accountants prepare and file tax returns, ensuring accuracy to minimize liabilities.

- Financial Reporting: They generate reports like balance sheets and income statements, presenting an organization’s financial status clearly.

- Auditing: Accountants conduct audits to verify the accuracy of financial records, enhancing transparency.

- Budgeting: They assist in creating budgets to guide spending and investment decisions.

Essential Skills

Successful accountants possess specific skills that enable them to excel in their roles. These skills include:

- Analytical Skills: Strong analytical abilities help accountants interpret complex data effectively.

- Attention to Detail: Precision is vital; minor errors can lead to significant issues in finance.

- Communication Skills: Accountants must explain financial concepts clearly to clients or stakeholders who may not have a finance background.

- Technical Proficiency: Familiarity with accounting software is essential for efficiency and accuracy.

Understanding these aspects of the accountant’s role highlights their importance in the financial landscape, empowering you or your business toward better management practices.

Types of Accountants

Understanding the various types of accountants helps you choose the right professional for your financial needs. Each type specializes in different areas, providing unique services tailored to specific requirements.

Public Accountants

Public accountants offer services to a variety of clients, including individuals and businesses. They focus on tax preparation, auditing, and consulting. Many public accountants hold certifications like CPA (Certified Public Accountant), which enhances their credibility. They often work for accounting firms or run their own practices. For example, a public accountant might prepare tax returns for small business owners or provide audit services for non-profits.

Management Accountants

Management accountants play a crucial role in internal decision-making within organizations. They analyze financial data to assist management in strategic planning and performance evaluation. Their responsibilities often include budgeting, forecasting, and cost management. For instance, a management accountant might develop financial reports that help executives understand operational efficiency and profitability trends.

Forensic Accountants

Forensic accountants specialize in investigating financial discrepancies and fraud cases. They combine accounting skills with investigative techniques to uncover evidence suitable for court proceedings. These professionals often work with law enforcement agencies or legal teams during litigation processes related to fraud or embezzlement cases. A forensic accountant may analyze bank statements to identify suspicious transactions or quantify damages in a legal dispute.

Educational Pathways to Become an Accountant

Becoming an accountant involves specific educational pathways that equip you with the necessary skills and knowledge. Understanding these pathways helps in planning your journey toward a successful accounting career.

Degree Requirements

Most accountants start with a bachelor’s degree in accounting or a related field. A typical program includes courses like financial accounting, managerial accounting, taxation, and auditing. Many universities offer specialized tracks, such as forensic accounting or tax policy, which can enhance your expertise.

After earning a bachelor’s degree, pursuing a master’s degree in accounting or business administration (MBA) often strengthens your qualifications. This advanced education may cover complex topics like financial analysis and corporate strategy.

Certifications and Licenses

Certification is crucial for advancing in the accounting profession. The Certified Public Accountant (CPA) designation is one of the most recognized credentials. To qualify for this certification, you must pass the CPA exam and meet state-specific education and experience requirements.

Other valuable certifications include:

- Certified Management Accountant (CMA): Focuses on management skills.

- Chartered Financial Analyst (CFA): Emphasizes investment management.

- Enrolled Agent (EA): Specializes in tax representation before the IRS.

Acquiring these licenses boosts credibility and opens up more job opportunities in various sectors of accounting.

Importance of Accountants in Business

Accountants play a crucial role in ensuring the financial health of businesses. They provide essential insights and maintain compliance with regulations, contributing significantly to strategic decision-making.

Financial Management

Accountants assist in effective financial management by offering precise budgeting and forecasting. They analyze spending patterns and help allocate resources efficiently. For instance, they might create detailed cash flow statements that reveal potential shortfalls or surpluses, enabling you to make informed decisions. By implementing robust accounting systems, accountants minimize errors and enhance tracking of expenses.

Compliance and Regulations

Accountants ensure adherence to laws and regulations governing financial practices. They prepare necessary documentation for tax filings, helping you avoid penalties or legal issues. Moreover, they stay updated on changes in legislation that affect your business operations. Their expertise can produce compliance reports required for audits or regulatory reviews, instilling confidence among stakeholders about your business’s financial integrity.

Future of the Accounting Profession

The future of the accounting profession revolves around adapting to technological advancements and emerging trends. Accountants are set to play a pivotal role in navigating these changes.

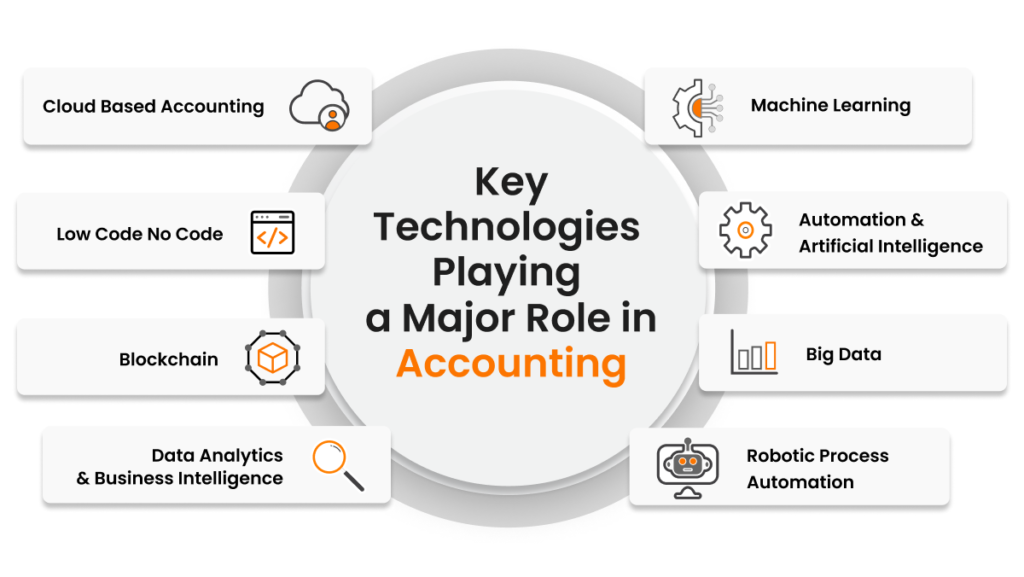

Technology and Automation

Technology is transforming how accountants perform their duties. Automation tools streamline repetitive tasks, allowing accountants to focus on strategic roles. For instance, software like QuickBooks automates invoicing and expense tracking, which saves time and reduces errors. Additionally, cloud computing enables real-time financial monitoring. It allows you to access data anytime, anywhere.

Artificial intelligence (AI) enhances decision-making processes. AI algorithms analyze large datasets quickly, uncovering insights that might go unnoticed. Tools like Xero utilize machine learning for predictive analytics, aiding in budgeting and forecasting.

Emerging Trends

The shift toward remote work is reshaping accounting practices. Many firms now offer flexible working arrangements, increasing job satisfaction among accountants. This trend leads to a broader talent pool as geographical limitations diminish.

Sustainability reporting is gaining traction. Companies are increasingly held accountable for their environmental impact, prompting accountants to develop expertise in this area. As regulations evolve, sustainability-focused certifications will likely become essential for professionals aiming to stay competitive.

Data analytics plays a crucial role in modern accounting. Accountants who can interpret complex data sets provide valuable insights that drive business strategy. Proficiency in data visualization tools like Tableau becomes an asset for those seeking advancement within the profession.

Embracing these technological advancements and trends positions accountants for success in an ever-evolving landscape.