When you provide services, getting paid promptly is crucial for your business’s cash flow. That’s where an invoice for services comes into play. This essential document not only outlines the work you’ve done but also serves as a formal request for payment. Have you ever wondered what makes an invoice effective?

Understanding Invoice For Services

Invoices for services serve a critical role in the financial interactions between service providers and clients. They detail the services performed and request payment, ensuring both parties maintain clarity in their transactions.

Definition And Importance

An invoice for services is a document that outlines what work was completed, when it was done, and how much it’s worth. It’s important because it formalizes requests for payment, helping to keep records clear. Without an invoice, misunderstandings about payments can arise. Businesses rely on invoices to track revenue and manage cash flow effectively.

Key Components Of An Invoice

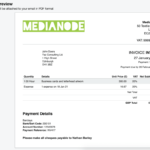

Several key components make up an effective invoice:

- Service Description: Clearly state the services provided.

- Date of Service: Indicate when the work took place.

- Invoice Number: Assign a unique identifier for tracking purposes.

- Payment Terms: Specify when payment is due (e.g., within 30 days).

- Total Amount Due: Clearly outline the total charge for services rendered.

Including these elements ensures that your invoices convey all necessary information efficiently, reducing confusion and promoting timely payments.

Types Of Invoices For Services

Invoices come in various types, each serving a specific purpose. Understanding these types helps streamline billing processes and improve payment efficiency.

Standard Invoice

A Standard Invoice details the services provided to a client along with the total amount due. It typically includes information like:

- Invoice number: Unique identifier for tracking.

- Client’s information: Name and contact details.

- Service description: Clear breakdown of what was done.

- Payment terms: When payment is expected.

Using a standard invoice ensures clarity in transactions, promoting timely payments.

Recurring Invoice

A Recurring Invoice is used for services billed regularly, such as monthly subscriptions or ongoing contracts. Key features include:

- Schedule: Clearly defines billing intervals (weekly, monthly).

- Consistent amounts: Same total due each period.

- Automated sending options: Saves time by automating delivery.

Utilizing recurring invoices simplifies financial management for both providers and clients.

Pro Forma Invoice

A Pro Forma Invoice acts as a preliminary bill before services are rendered. It outlines expected costs and serves various purposes, including:

- Budgeting tool: Helps clients estimate expenses upfront.

- Customs documentation: Used for international shipping requirements.

- Formal agreement of terms: Clarifies pricing before service initiation.

Implementing pro forma invoices can enhance transparency and foster trust between service providers and clients.

Creating An Effective Invoice For Services

Creating an effective invoice for services ensures clear communication and facilitates timely payments. Focus on the design, layout, and essential information to optimize your invoices.

Design And Layout Tips

Effective design enhances readability and professionalism. Consider these tips:

- Use a clean layout: Keep it simple with ample white space.

- Choose legible fonts: Opt for standard fonts like Arial or Times New Roman.

- Incorporate branding elements: Include your logo and brand colors for consistency.

- Organize sections clearly: Use headings to separate different parts of the invoice.

These aspects not only make invoices visually appealing but also improve client understanding.

Essential Information To Include

Including all necessary details helps prevent confusion. Make sure to add:

- Your business name and contact information: Clearly state who is billing.

- Client’s name and contact details: Ensure accurate identification of the recipient.

- Invoice date and due date: Indicate when payment is expected.

- Unique invoice number: Assign a number for tracking purposes.

- Detailed list of services rendered: Describe each service with dates, hours worked, rates, and total costs.

Common Mistakes To Avoid

Mistakes in invoicing can lead to delayed payments and strained client relationships. Recognizing these pitfalls helps ensure smooth transactions.

Incomplete Information

Incomplete information on an invoice can cause confusion. For example, if you forget to include your business name or contact details, clients might struggle to reach you for payment inquiries. Always incorporate essential elements such as:

- Business name: Clearly state your company’s name.

- Client information: Include the client’s full name and address.

- Invoice number: Assign a unique identifier for tracking.

- Service description: Provide detailed descriptions of each service rendered.

Omitting even one of these components may lead to misunderstandings about what the client is being charged for.

Miscalculating Costs

Miscalculating costs results in discrepancies that can frustrate clients. Double-check calculations before sending invoices, especially when items or services vary in pricing. Some common issues include:

- Incorrect item prices: Ensure that all charges reflect agreed-upon rates.

- Adding taxes incorrectly: Verify tax percentages applied to avoid overcharging.

- Wrong discounts applied: Confirm any discounts are accurately reflected on the invoice.

Taking time to review costs prevents disputes and maintains trust with your clients.