When it comes to managing your finances, understanding invoice examples is crucial. Whether you’re a freelancer, small business owner, or part of a larger corporation, knowing how to create and customize invoices can save you time and help maintain professionalism. Have you ever wondered what makes an invoice effective?

Importance Of Invoice Examples

Invoice examples serve as a vital tool for anyone managing finances. You can see how different elements come together in a professional layout. These examples guide you in structuring your invoices correctly, ensuring clarity and efficiency.

Understanding the components of an invoice is essential. For instance, each invoice should include:

- Business name and logo

- Customer details

- Itemized list of services or products

- Dates and payment terms

This helps prevent misunderstandings with clients. When you present clear invoices, it fosters trust and encourages timely payments.

You might wonder about customization. Invoice examples show how to tailor your documents to fit your brand identity, making them more recognizable.

Additionally, these samples can save time. By using established formats, you streamline the invoicing process. This efficiency means less time spent on paperwork and more on growing your business.

Referring to invoice examples enhances professionalism while simplifying financial management tasks.

Types Of Invoices

Understanding the various types of invoices can streamline your billing process. Each invoice type serves a specific purpose and fits different business needs.

Standard Invoice

A standard invoice is the most common type used by businesses. It includes details such as your business name, customer information, itemized list of products or services, and payment terms. This format provides clarity on what services rendered or products sold, ensuring both parties are on the same page.

Pro Forma Invoice

A pro forma invoice acts as a preliminary bill of sale. It’s often issued before delivering goods or services to outline expected costs. Customers receive this document to understand pricing without it being an official request for payment. It helps in budget planning and securing financing.

Recurring Invoice

A recurring invoice simplifies billing for ongoing services. If you provide subscription-based services or regular deliveries, this format automatically charges customers at set intervals—weekly, monthly, or annually. This consistency ensures timely payments while reducing administrative workload.

Credit Invoice

A credit invoice reflects adjustments to previous transactions. If there’s been an overcharge or return of goods, issuing a credit invoice rectifies the balance due. This document credits the customer’s account against future purchases or refunds them directly, maintaining accurate financial records.

Key Elements Of An Invoice

Understanding the key elements of an invoice enhances clarity and professionalism in your financial transactions. Each component plays a crucial role in communicating essential information to your clients.

Invoice Header

The Invoice Header provides vital information about your business. It typically includes:

- Your business name: Make it prominent.

- Your logo: This reinforces brand identity.

- Contact details: Include phone number, email, and address.

- Invoice number: Assign a unique identifier for tracking.

Clear headers help clients recognize invoices quickly.

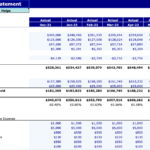

Itemized List

An effective Itemized List breaks down services or products provided. Ensure you include:

- Description of each item: Be specific about what’s offered.

- Quantity: Specify how many units were sold or hours worked.

- Unit price: Show the cost per item or hour.

- Total amount for each line item: Clearly display calculations.

A detailed itemized list avoids confusion regarding charges.

Payment Terms

Including clear Payment Terms sets expectations between you and your client. These terms should cover:

- Due date: State when payment is expected.

- Payment methods accepted: Specify options like credit card, PayPal, or bank transfer.

- Late fees (if applicable): Mention any penalties for overdue payments.

Best Practices For Creating Invoices

Creating effective invoices is crucial for maintaining professionalism and ensuring timely payments. By following best practices, you can enhance your invoicing process significantly.

Customization Tips

Customization strengthens your brand identity. Incorporate your business name, logo, and colors to make invoices instantly recognizable. Use a consistent format across all invoices, including fonts and layouts, to foster familiarity with clients.

Consider adding personalized notes or messages in each invoice to build rapport with customers. Include specific references to previous conversations or projects, making the communication more personal. Tailoring payment terms based on client needs can also improve satisfaction.

Common Mistakes To Avoid

Avoiding common mistakes helps maintain professionalism and clarity in your invoices.

By steering clear of these pitfalls, you streamline the invoicing process while reinforcing trust with clients.