In recent years, we’ve witnessed a series of shocking events that have rocked the financial world. High-profile accounting scandals and the global financial crisis are examples of systemic failures that expose vulnerabilities in our economic systems. These incidents not only impacted companies but also shattered public trust and raised serious questions about accountability.

What drives these crises? Is it sheer greed or a lack of oversight? As you delve deeper into this article, you’ll uncover how these scandals serve as cautionary tales for investors and policymakers alike. By examining the lessons learned from these pivotal moments, you can gain valuable insights into preventing future disasters and fostering a more transparent financial landscape. Get ready to explore the intricate web of factors that led to these monumental failures and their lasting implications on today’s economy.

High-Profile Accounting Scandals

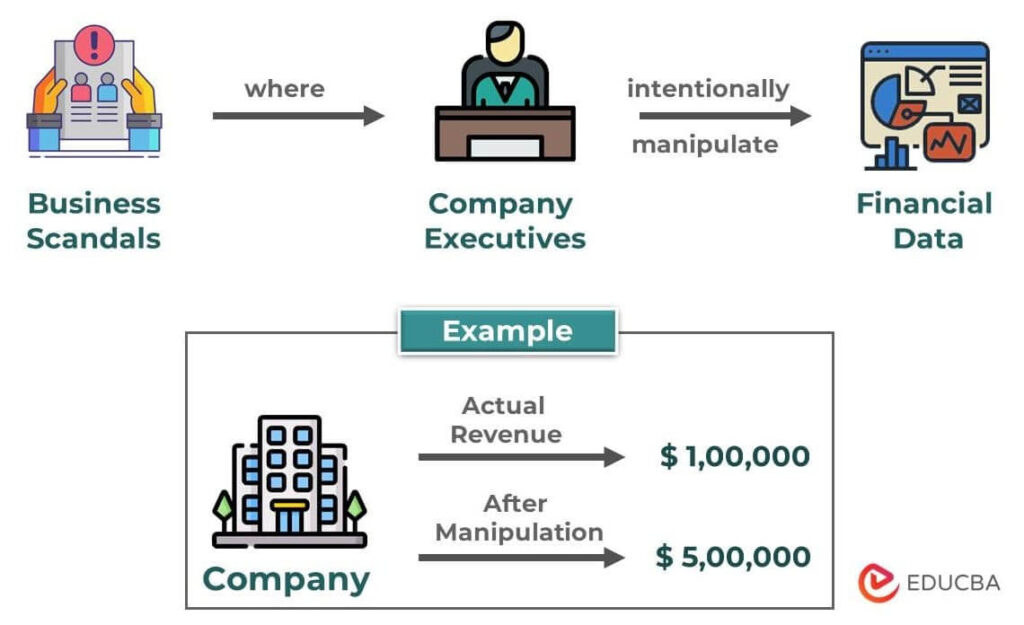

High-profile accounting scandals illustrate significant failures in corporate governance and ethics. These events not only erode public trust but also expose vulnerabilities in financial reporting systems.

Overview of Major Scandals

Several notorious scandals have shaped the landscape of accounting:

- Enron: Once a giant in energy trading, Enron’s fraudulent practices led to its bankruptcy in 2001. Executives concealed debt through complex partnerships.

- WorldCom: In 2002, WorldCom revealed $3.8 billion in inflated assets. Its collapse marked one of the largest bankruptcies in U.S. history.

- Lehman Brothers: This investment bank filed for bankruptcy in 2008, with $600 billion in debt, largely due to risky investments and misleading financial statements.

These examples highlight systemic issues within organizations that prioritize profit over ethical standards.

Impact on the Financial Industry

The repercussions of these scandals extend beyond individual companies:

- Regulatory Changes: The Sarbanes-Oxley Act emerged post-Enron, enforcing stricter regulations on financial reporting.

- Investor Confidence: Trust among investors plummeted as people questioned the reliability of financial statements.

- Market Volatility: Stock prices fluctuated significantly following revelations of fraud, leading to unstable market conditions.

Ultimately, these scandals prompted a reevaluation of corporate governance practices and increased calls for transparency across industries.

The Global Financial Crisis

The global financial crisis, which peaked in 2008, represents a significant failure of financial systems worldwide. It exposed weaknesses in regulation and oversight, leading to widespread economic turmoil.

Causes and Contributing Factors

Several factors contributed to the global financial crisis. Subprime mortgage lending played a crucial role as banks extended loans to borrowers with poor credit histories. As housing prices fell, many homeowners defaulted on their mortgages.

Additionally, excessive risk-taking by financial institutions amplified the problem. Investment banks engaged in high-risk trading activities without adequate capital reserves. Furthermore, lack of transparency in complex financial products like mortgage-backed securities made it difficult for investors to assess their risks accurately.

- Poor regulatory oversight

- High levels of consumer debt

- Securitization of risky assets

Consequences for Global Economies

The consequences were severe and far-reaching. Economic recession hit multiple countries as unemployment rates soared and consumer spending plummeted. Many businesses faced bankruptcy or severe losses due to reduced demand.

Moreover, government bailouts became necessary for major banks and corporations deemed “too big to fail.” This intervention raised concerns about moral hazard and future accountability within the banking sector.

- Loss of millions of jobs globally

- Collapse of major financial institutions

- Increased public debt due to stimulus measures

Common Themes in Both Events

Both high-profile accounting scandals and the global financial crisis share significant underlying themes that highlight systemic issues. Understanding these commonalities is crucial for preventing future occurrences.

Lack of Transparency

Lack of Transparency characterized many accounting scandals, making it difficult for stakeholders to assess actual financial health. For instance, Enron’s complex financial statements obscured true liabilities, misleading investors and regulators alike. Similarly, during the global financial crisis, opaque mortgage-backed securities concealed risks that ultimately led to widespread economic fallout. This absence of clear information eroded trust and fueled market instability.

Regulatory Failures

Regulatory Failures played a pivotal role in both events, underscoring the need for stronger oversight. In the case of WorldCom, inadequate regulations allowed management to manipulate earnings without detection. Likewise, during the 2008 crisis, regulators failed to address reckless lending practices among banks. These shortcomings revealed vulnerabilities within regulatory frameworks and emphasized the necessity for reforms aimed at enhancing accountability and protecting investors’ interests.

Lessons Learned

High-profile accounting scandals and the global financial crisis reveal critical lessons for future financial practices. Understanding these lessons helps prevent similar occurrences and fosters trust in economic systems.

Importance of Ethical Standards

Ethical standards are essential in maintaining public trust. You can see this clearly with Enron, where a lack of ethics led to fraudulent activities. The scandal resulted in thousands losing jobs and savings. WorldCom also demonstrated how unethical behavior can distort financial reporting, leading to significant investor losses. These events show why companies must prioritize integrity over profit.

Strengthening Regulations

Strengthening regulations is crucial for preventing future crises. After the 2008 financial crisis, regulatory reforms became necessary. For instance, the Dodd-Frank Act aimed to improve oversight and accountability within the banking sector. Additionally, implementing stricter rules on accounting practices ensures transparency. Such measures help protect investors by minimizing risks associated with inadequate regulations or corporate malfeasance.

By learning from past mistakes, you contribute to a more transparent and trustworthy financial landscape.