Understanding financial statements is crucial for anyone looking to grasp the financial health of a business. These documents serve as a window into a company’s performance, revealing insights that can help you make informed decisions. But do you know what each statement entails and how they interconnect?

Overview Of Financial Statements

Financial statements are crucial for understanding a company’s financial position. They consist of three primary types: the balance sheet, income statement, and cash flow statement. Each serves a distinct purpose in assessing performance.

The balance sheet provides a snapshot of assets, liabilities, and equity at a specific time. For instance, if you look at Apple’s balance sheet from 2025, you’ll see total assets valued around $351 billion, with liabilities of approximately $287 billion.

The income statement shows revenue and expenses over a period. For example, Amazon’s income statement for Q4 2025 reported revenues exceeding $149 billion against operating expenses of about $138 billion.

The cash flow statement tracks cash inflows and outflows during an accounting period. In Tesla’s 2025 report, the company generated $5.58 billion in cash flow from operations while investing $6.13 billion in capital expenditures.

Understanding these examples helps clarify how financial statements reflect business activities and guide decision-making processes effectively. Are you ready to dive deeper into each type?

Types Of Financial Statements

Understanding the various types of financial statements enhances your ability to evaluate a company’s financial health. Each statement offers unique insights into different aspects of a business’s performance.

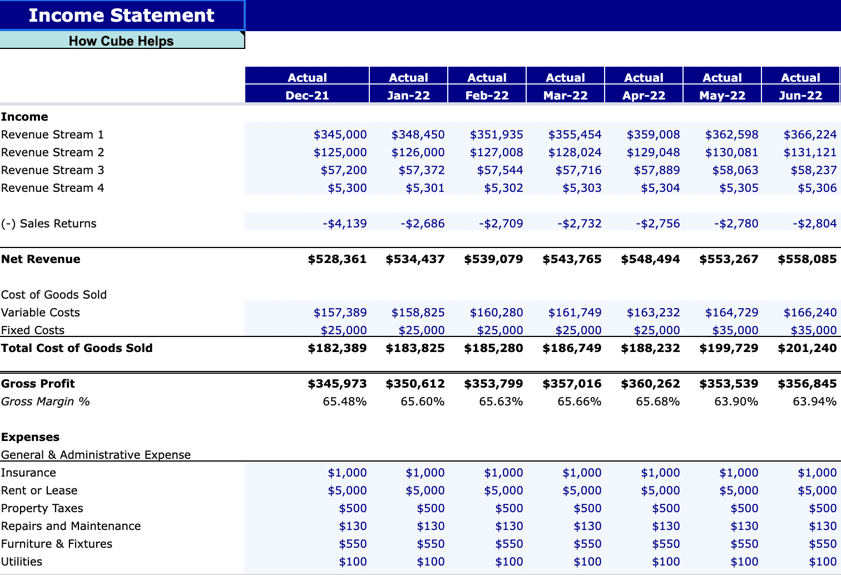

Income Statement

The Income Statement details revenue and expenses over a specific period, showing how much profit or loss a company generates. For example, in Q4 2025, Amazon reported revenues exceeding $149 billion against operating expenses of about $138 billion. This indicates strong profitability for that quarter. You can analyze trends over time by comparing multiple periods.

Balance Sheet

The Balance Sheet provides a snapshot of assets, liabilities, and equity at one point in time. For instance, Apple’s 2025 balance sheet showed total assets around $351 billion with liabilities close to $287 billion. This information is crucial because it highlights the company’s net worth and financial stability. You’ll see how resources are allocated and funded.

Cash Flow Statement

The Cash Flow Statement tracks cash inflows and outflows from operating, investing, and financing activities. In Tesla’s 2025 report, cash flow from operations was noted as $5.58 billion alongside capital expenditures of $6.13 billion. This data reveals the liquidity position of the company and its ability to meet obligations—essential for assessing operational efficiency and growth potential.

By reviewing these statements together, you gain comprehensive insights into a company’s overall performance and strategic direction.

Importance Of Financial Statements

Financial statements play a crucial role in understanding a company’s financial health. They provide essential insights into performance, guiding you in making informed decisions.

Decision Making

Financial statements significantly influence decision-making processes. For instance, when considering an investment, you can analyze the income statement to assess profitability and growth trends. If you’re evaluating whether to expand operations, reviewing cash flow statements helps determine if there are sufficient funds available for new projects. Accessing accurate data allows you to weigh risks and opportunities effectively.

Performance Evaluation

Evaluating a company’s performance relies heavily on its financial statements. Take the balance sheet as an example; it shows the relationship between assets and liabilities at any given time. By comparing different periods, you can identify trends in asset management or debt levels. Additionally, analyzing revenue growth through income statements reveals how well a company adapts to market conditions. These evaluations help establish benchmarks for future performance assessments and strategic planning.

By examining these aspects of financial statements, you’re better equipped to understand a business’s position and make sound decisions based on factual data.

Analyzing Financial Statements

Analyzing financial statements provides crucial insights into a company’s operations and financial health. Understanding these documents involves examining key financial ratios and common size statements, which highlight important trends and performance metrics.

Key Financial Ratios

Key financial ratios offer a quick way to evaluate a company’s performance. You can calculate these ratios using figures from the income statement or balance sheet. Here are some significant ratios:

- Current Ratio: Measures liquidity by dividing current assets by current liabilities. A ratio above 1 indicates good short-term financial health.

- Debt-to-Equity Ratio: Indicates leverage by comparing total debt to shareholders’ equity. A lower ratio suggests less risk in terms of financing.

- Return on Equity (ROE): Assesses profitability by dividing net income by shareholder equity. Higher percentages show effective management.

These ratios allow you to quickly gauge how effectively a company uses its resources, manages debt, and generates profits.

Common Size Statements

Common size statements express each line item as a percentage of a base figure, facilitating easy comparisons across time periods or companies. For instance, in an income statement, you can express all expenses as a percentage of total revenue.

This makes it easier to spot trends over time—like if operating expenses are growing faster than revenue—or compare different companies in the same industry regardless of their size.

You might find it useful to look at common size balance sheets too; they present assets and liabilities as percentages of total assets or total liabilities plus equity, helping identify shifts in asset management strategies.

Using both key financial ratios and common size statements creates a comprehensive picture that supports informed decision-making regarding investments or strategic planning.