Financial models are the backbone of strategic decision-making in any business. Have you ever wondered how companies forecast their future performance or evaluate investment opportunities? These powerful tools help you analyze various scenarios and understand the potential impact on your bottom line.

Understanding Financial Models

Financial models play a crucial role in guiding business decisions. They help forecast future performance and evaluate investment opportunities, enabling effective scenario analysis.

What Are Financial Models?

Financial models are mathematical representations of a company’s financial performance. They use historical data to predict future outcomes based on various assumptions. Common types include:

- Discounted Cash Flow (DCF) Model: Projects future cash flows and discounts them to present value.

- Comparative Company Analysis: Assesses a company’s value by comparing it with similar firms.

- Budgeting Models: Helps allocate resources for specific periods.

These models serve as essential tools in strategic planning.

Importance of Financial Models

The importance of financial models lies in their ability to support informed decision-making. By analyzing different scenarios, you can understand potential impacts on profitability. Key benefits include:

- Risk Assessment: Identifies potential risks associated with investments or changes in strategy.

- Performance Evaluation: Measures how well the company meets its financial goals.

- Investment Planning: Guides allocation of resources towards profitable ventures.

Ultimately, these models empower businesses to navigate uncertainties effectively.

Types of Financial Models

Financial models come in various forms, each serving distinct purposes. Understanding these types helps you choose the right model for your needs.

Discounted Cash Flow (DCF) Model

The Discounted Cash Flow (DCF) Model estimates the value of an investment based on its expected future cash flows. It discounts those cash flows to present value using a specific discount rate. For instance, if you’re evaluating a project that generates $100,000 annually over five years with a discount rate of 10%, you’d calculate the present value of those cash inflows to assess whether it’s a worthwhile investment.

Comparable Company Analysis (Comps)

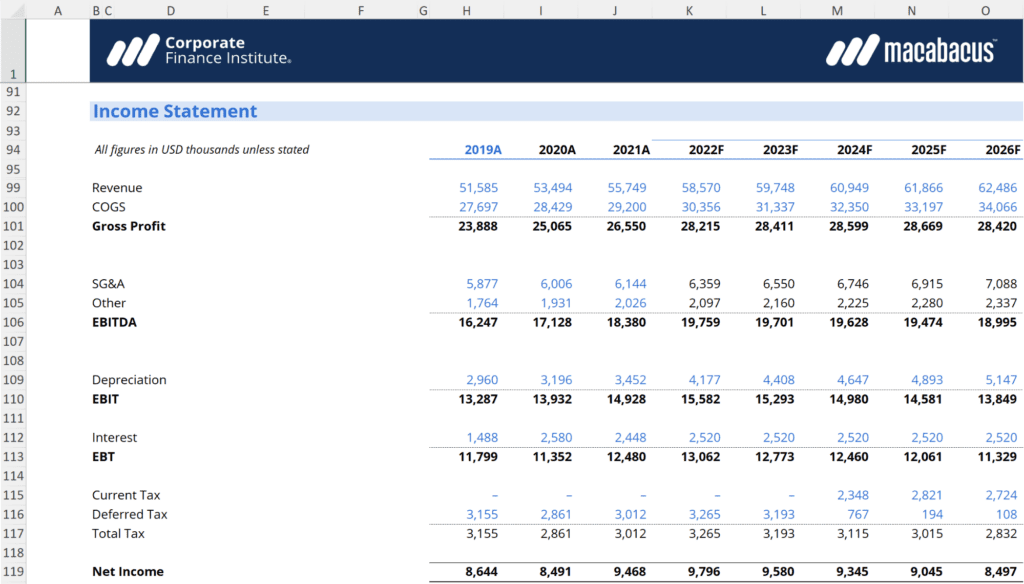

Comparable Company Analysis (Comps) involves comparing financial metrics of similar companies within the same industry. This method provides insights into valuation by looking at multiples like Price-to-Earnings (P/E) or Enterprise Value-to-EBITDA ratios. If Company A has a P/E ratio of 15 and operates similarly to Company B, which has a P/E ratio of 20, you might conclude that Company B is overvalued compared to its peers.

Mergers and Acquisitions (M&A) Model

An Mergers and Acquisitions (M&A) Model evaluates the financial impact of potential mergers or acquisitions on both companies involved. It incorporates projections for revenue growth, cost synergies, and financing methods. For example, if two companies expect combined revenues of $500 million post-merger with projected cost savings of $50 million annually, this model helps analyze how such changes could affect their overall valuation and profitability in future years.

Key Components of Financial Models

Understanding the key components of financial models is crucial for effective analysis. Each element plays a significant role in providing accurate forecasts and insights.

Assumptions and Inputs

Assumptions form the foundation of any financial model. They include expected growth rates, revenue projections, and cost estimates. For example:

- Revenue Growth Rate: You might estimate a 5% annual growth based on market trends.

- Cost of Goods Sold (COGS): Assuming COGS as 40% of sales can significantly impact profitability metrics.

These inputs are vital because they drive all subsequent calculations. Ensuring accuracy in your assumptions leads to better decision-making.

Calculations and Formulas

Calculations and formulas translate assumptions into actionable insights. This includes applying methods like Discounted Cash Flow (DCF) or Net Present Value (NPV). Here are some examples:

- DCF Calculation: Use projected cash flows over five years, discounting them at an appropriate rate, say 10%.

- NPV Formula: NPV = ∑(Cash Flows / (1 + r)^t), where ‘r’ represents your discount rate.

By accurately executing these calculations, you derive meaningful outputs that inform strategic decisions.

Best Practices for Building Financial Models

Building effective financial models requires careful attention to detail and a structured approach. Follow these best practices to enhance the quality and usability of your models.

Structuring Your Model

Organizing your model logically is crucial. Start with clear sections, such as inputs, calculations, and outputs. This structure improves readability and navigation.

- Inputs: Gather all necessary data, including historical performance figures and assumptions.

- Calculations: Place formulas in dedicated areas to avoid cluttering input cells.

- Outputs: Present results clearly, using graphs or tables for better visualization.

Ensure each section connects smoothly to maintain flow. Consistency in formatting aids understanding.

Tips for Accuracy and Clarity

Accuracy is vital when building financial models. Small errors can lead to significant miscalculations. Here are some tips:

- Double-check formulas: Verify that every formula references the correct cells.

- Use named ranges: Named ranges simplify formula management by making them easier to read.

- Document assumptions: Clearly state any assumptions made within the model for transparency.

Additionally, keep it simple; complex models can confuse users. Clear labeling of all components enhances clarity, ensuring anyone can follow along easily.