Understanding financial acumen is crucial in today’s fast-paced economy. But what exactly does financial acumen mean? It goes beyond just knowing numbers; it’s about making informed decisions that can significantly impact your personal or business finances. Whether you’re a budding entrepreneur or managing household budgets, having strong financial acumen can set you apart.

Understanding Financial Acumen Definition

Financial acumen refers to the ability to understand and make effective decisions regarding financial matters. This skill encompasses more than just knowing numbers; it involves interpreting data and applying that knowledge in real-world scenarios.

Importance of Financial Acumen

Financial acumen plays a crucial role in both personal and professional contexts. For individuals, strong financial acumen helps manage budgets effectively, ensuring you allocate resources wisely. In business, leaders with financial acumen can analyze market trends, making informed strategic decisions that drive profitability. Without this understanding, navigating complex financial landscapes becomes challenging.

Key Components of Financial Acumen

Several key components define financial acumen:

- Analytical Skills: The ability to interpret financial statements and identify trends.

- Budgeting Knowledge: Understanding how to create and maintain a budget.

- Investment Insight: Knowing how different investment options work and their associated risks.

- Risk Management: Recognizing potential financial risks and developing strategies to mitigate them.

These components collectively enhance your capacity to make sound financial choices in various situations.

Practical Applications of Financial Acumen

Understanding financial acumen enhances decision-making both in business and personal finance. This skill allows you to navigate complex financial landscapes effectively.

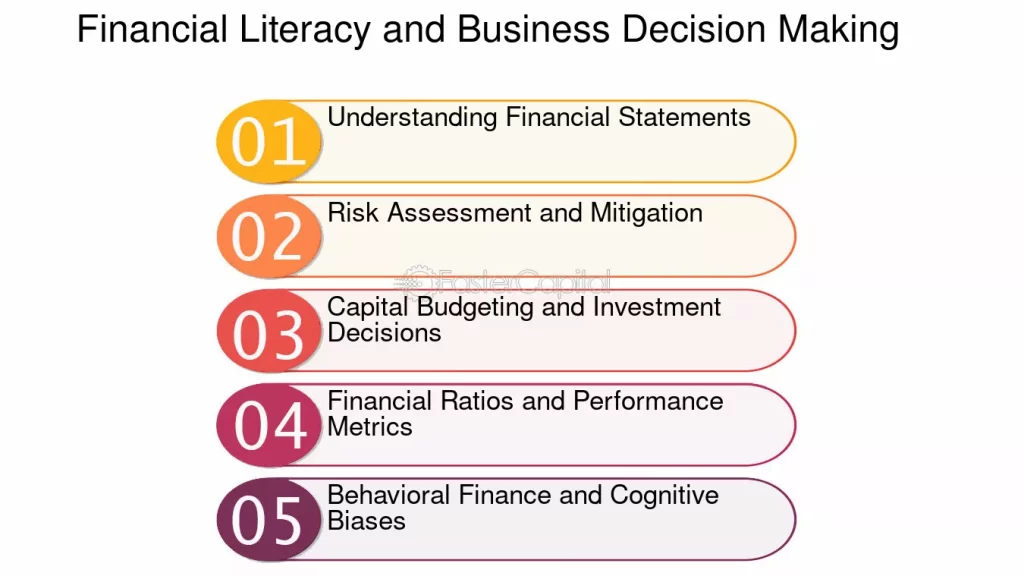

In Business Decision-Making

In the realm of business, strong financial acumen empowers leaders to make data-driven decisions. For instance, analyzing profit margins helps identify which products yield the highest returns.

Consider these scenarios:

- Budget Allocation: You assess departmental performance and allocate resources where they’re most effective.

- Investment Decisions: You evaluate potential investments by conducting thorough market research.

- Cost Management: You track expenses meticulously, identifying areas for cost reduction without sacrificing quality.

Such abilities can lead to improved profitability and a competitive edge in your industry.

In Personal Finance Management

When managing personal finances, financial acumen enables smarter budgeting and saving strategies. This means you’re less likely to overspend or miss savings opportunities.

Here are practical examples:

- Monthly Budgeting: You create a budget that reflects income versus expenses, ensuring you live within your means.

- Debt Management: You prioritize paying off high-interest debts first, reducing overall interest payments over time.

- Investment Planning: You diversify your investment portfolio based on risk tolerance and financial goals.

These actions foster long-term financial health and stability.

Developing Financial Acumen

Developing financial acumen enhances your decision-making skills in both personal and professional contexts. It involves gaining knowledge and applying it effectively to manage finances.

Education and Training Resources

Several resources exist to help you build financial acumen:

- Online Courses: Platforms like Coursera or Udemy offer courses that cover budgeting, investment strategies, and risk management.

- Books: Titles such as “The Intelligent Investor” by Benjamin Graham provide insights into investing fundamentals.

- Workshops: Local community colleges often host workshops focused on personal finance topics.

- Webinars: Many financial institutions conduct free webinars on various aspects of finance.

These tools can significantly improve your understanding of financial concepts.

Tips for Improving Financial Skills

You can enhance your financial skills through practical steps:

- Set Goals: Establish clear, measurable objectives for your finances.

- Track Expenses: Use apps or spreadsheets to monitor daily spending patterns.

- Budget Regularly: Create monthly budgets to allocate funds effectively.

- Read Financial News: Stay updated with sources like Bloomberg or CNBC for market trends and analysis.

- Engage with Professionals: Consult financial advisors for personalized advice tailored to your situation.

Implementing these tips fosters stronger financial awareness and better management practices in everyday life.

Common Misconceptions About Financial Acumen

Many misconceptions surround financial acumen, often leading to confusion about its true nature. Understanding these can help you better appreciate the skill’s importance.

Financial Acumen vs. Financial Literacy

Financial acumen is not the same as financial literacy. While both involve understanding finances, financial literacy focuses on basic knowledge and concepts like budgeting and saving. In contrast, financial acumen encompasses deeper insights into analyzing data, making strategic decisions, and understanding market dynamics. For instance:

- Financial literacy equips you with skills to create a budget.

- Financial acumen enables you to assess which investments will yield the best returns.

Knowing this distinction clarifies why one needs both skills for effective personal or business finance management.

The Role of Experience in Financial Acumen

Experience significantly enhances your financial acumen. While theoretical knowledge forms a foundation, applying that knowledge in real-world scenarios develops intuition and decision-making capabilities. Consider these examples:

- Making investment choices: You learn more about risk assessment through actual trading experiences than by reading textbooks alone.

- Managing budgets: Regularly handling different types of expenses teaches you how to adjust plans based on cash flow changes.

So, engaging actively in financial activities sharpens your abilities over time, reinforcing why hands-on experience is invaluable.