Understanding financial accounting examples can transform the way you view your business’s financial health. Have you ever wondered how companies track their income and expenses? These examples provide a clear lens into the practices that reveal profitability and sustainability.

Overview of Financial Accounting Examples

Understanding financial accounting examples is crucial for grasping a company’s economic activities. These examples provide insights into how businesses manage their finances.

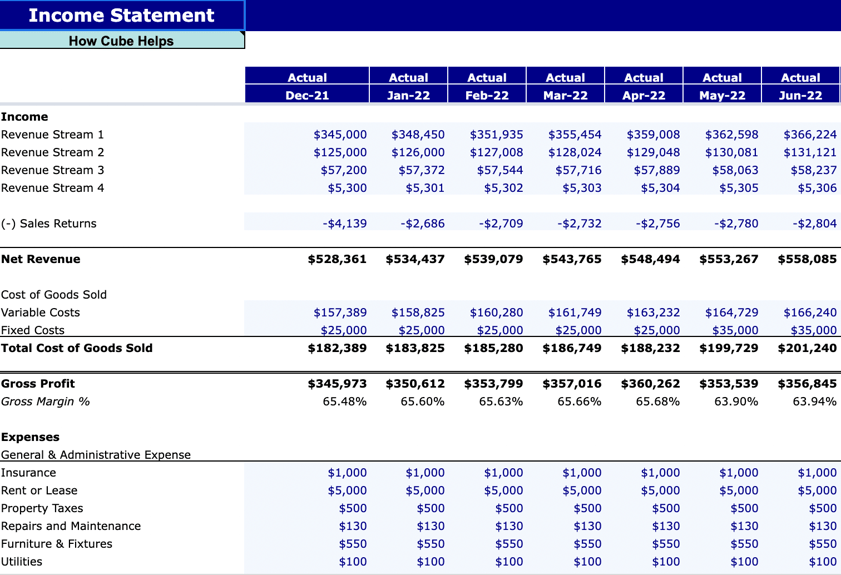

One common example is the income statement. It summarizes revenues and expenses over a specific period, showing profitability. You’ll see details such as:

- Revenue: Total sales generated.

- Cost of Goods Sold (COGS): Direct costs tied to production.

- Operating Expenses: Costs related to day-to-day operations.

Another example is the balance sheet. This document displays a company’s assets, liabilities, and equity at a single point in time. Key components include:

- Assets: Resources owned by the company, like cash or inventory.

- Liabilities: Obligations owed to outside parties, such as loans.

- Equity: Owner’s stake in the business after liabilities are subtracted from assets.

Additionally, the cash flow statement illustrates how cash moves in and out of a business. It highlights three main activities:

- Operating Activities: Cash generated from core business functions.

- Investing Activities: Cash used for investments in equipment or property.

- Financing Activities: Cash exchanged with investors or lenders.

These examples collectively help you assess financial health effectively. You might ask yourself how these documents influence decision-making within the organization? The clarity they provide can guide strategic planning and investment choices significantly.

Types of Financial Accounting Examples

Understanding various types of financial accounting examples helps in grasping how businesses report their financial performance. Here are some key examples to consider.

Balance Sheet Examples

A balance sheet provides a snapshot of a company’s financial status at a specific point in time. It includes three main components: assets, liabilities, and equity. For instance:

- Assets: Cash, inventory, property

- Liabilities: Loans, accounts payable, mortgages

- Equity: Common stock, retained earnings

These elements give insights into what the company owns and owes. By analyzing balance sheets from different periods, you can identify trends in financial health.

Income Statement Examples

An income statement summarizes revenues and expenses over a certain period. This document highlights profitability by showing net income or loss. Key components include:

- Revenue: Total sales generated

- Cost of Goods Sold (COGS): Direct costs tied to production

- Operating Expenses: Salaries, rent, utilities

For example, if a company reports $500,000 in revenue and $300,000 in total expenses for the year, its net income equals $200,000. This clarity on profits guides stakeholders’ decisions.

Cash Flow Statement Examples

A cash flow statement tracks the inflow and outflow of cash within an organization during a given period. It focuses on three areas:

- Operating Activities: Revenue-generating operations

- Investing Activities: Purchases or sales of long-term assets

- Financing Activities: Debt issuance or dividend payments

For example, if your business generates $100,000 from operating activities but spends $50,000 on investing activities and pays out $20,000 in dividends, understanding these flows can help manage liquidity effectively.

By examining these financial accounting examples—balance sheets for stability analysis; income statements for profit assessment; cash flow statements for liquidity insight—you gain valuable perspectives on business performance.

Common Applications of Financial Accounting Examples

Financial accounting examples serve various practical purposes in business operations. They provide clarity on financial performance and inform strategic decisions.

Business Decision Making

Business decision making relies heavily on financial accounting examples. You can use an income statement to evaluate profitability, comparing revenues against expenses. For instance, if your company consistently shows higher operating costs than sales revenue, it might be time to reassess pricing strategies or cost management practices.

Additionally, the balance sheet offers a snapshot of your assets versus liabilities. This insight helps determine whether you should pursue expansion opportunities or focus on debt reduction. The cash flow statement highlights cash movement, guiding investment decisions and ensuring you maintain sufficient liquidity for daily operations.

Compliance and Reporting

Compliance and reporting are critical aspects of financial accounting examples. Regulatory bodies require accurate financial statements to ensure transparency and accountability. For example, public companies must file quarterly reports that include income statements and balance sheets with the Securities and Exchange Commission (SEC).

Moreover, adhering to Generally Accepted Accounting Principles (GAAP) ensures consistency in reporting. Companies often prepare annual reports that summarize their financial status for stakeholders. These documents not only fulfill legal obligations but also build trust with investors by showcasing operational effectiveness and fiscal responsibility.

Tools for Analyzing Financial Accounting Examples

Understanding financial accounting examples requires the right tools. These tools help in breaking down complex data into manageable insights. Here’s a look at two primary categories of tools that can enhance your analysis.

Accounting Software

Accounting software streamlines financial processes, making it easier to generate key reports. Popular options include:

- QuickBooks: Ideal for small businesses, it offers invoicing, expense tracking, and reporting features.

- Xero: Cloud-based software with multi-currency support and real-time collaboration features.

- Sage Intacct: Suited for larger organizations, this tool provides advanced financial management capabilities.

These platforms automate calculations and ensure accuracy in reporting. They also facilitate compliance with regulatory standards by maintaining organized records.

Financial Analysis Techniques

Employing effective financial analysis techniques offers deeper insights into your accounting examples. Key techniques include:

- Ratio Analysis: This method evaluates relationships between different financial statement figures, like profitability ratios and liquidity ratios.

- Trend Analysis: By examining historical data over time, you identify patterns that may inform future performance predictions.

- Variance Analysis: This technique compares actual results against budgeted figures to uncover discrepancies.

Each technique highlights specific aspects of your business’s financial health. Using these methods consistently enhances decision-making and strategic planning efforts.