Imagine you’re trying to predict the future based on past data. This is where extrapolation comes into play. It’s a powerful tool that allows you to make educated guesses about what might happen next by extending existing trends beyond their current limits. But how reliable are these predictions?

Understanding Extrapolation

Extrapolation uses past data to predict future outcomes, making it a valuable tool in various fields. It extends current trends beyond existing data points, offering insights into potential developments.

Definition of Extrapolation

Extrapolation refers to the process of estimating unknown values by extending known information. For example, if you observe that sales have increased by 10% each quarter for two years, you might predict a similar increase for the next quarter. This technique relies on the assumption that past patterns will continue.

Importance in Various Fields

Extrapolation plays a crucial role in multiple disciplines:

- Economics: Economists use extrapolation to forecast GDP growth or inflation rates based on historical trends.

- Healthcare: Healthcare professionals project patient needs or disease outbreak patterns using past health data.

- Climate Science: Scientists estimate future climate conditions by analyzing temperature and precipitation records over time.

- Finance: Investors apply extrapolation to analyze stock performance and predict future market movements.

Types of Extrapolation

Extrapolation can be categorized into different types, each useful in various contexts. Understanding these types helps you apply the right method to your data.

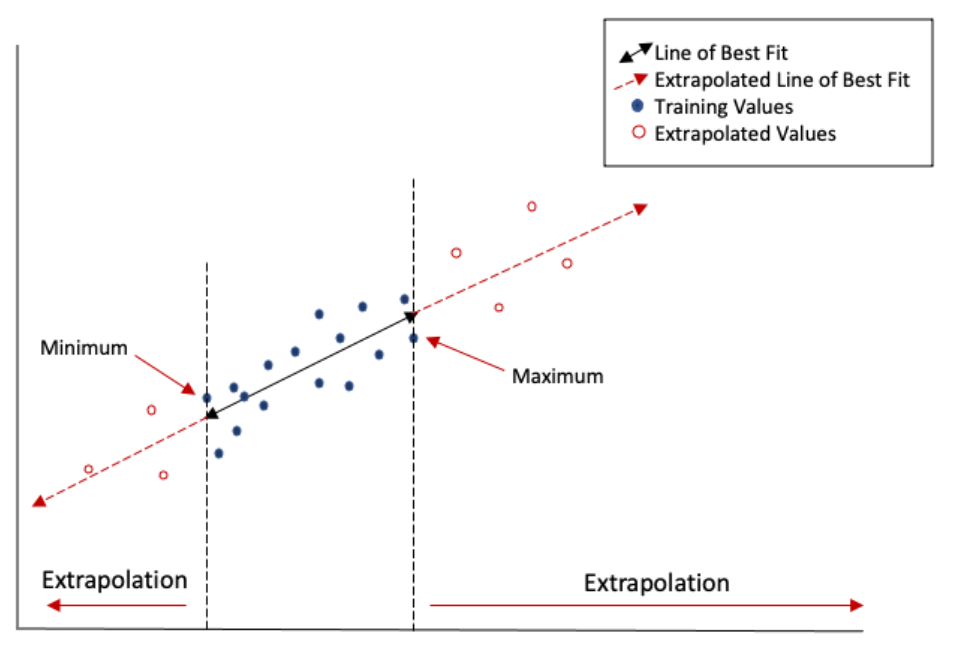

Linear Extrapolation

Linear extrapolation assumes that the trend in your data continues in a straight line. This approach is straightforward and often used when data appears consistent over time. For example, if you track monthly sales growth and notice an increase of $1,000 per month for six months, projecting this trend suggests future sales increases at the same rate.

Here are some scenarios where linear extrapolation is effective:

- Sales Forecasting: Predicting next quarter’s revenue based on past performance.

- Population Growth: Estimating future population numbers using historical census data.

- Temperature Trends: Projecting average temperatures based on previous years’ climate records.

Non-Linear Extrapolation

Non-linear extrapolation accounts for trends that change direction or accelerate over time. This technique suits complex data sets where relationships aren’t constant. For instance, if you’re studying internet usage growth, initial rapid growth may slow down as saturation occurs; thus, a non-linear model fits better.

Consider these examples of non-linear extrapolation:

- Economic Indicators: Analyzing GDP growth rates that fluctuate due to economic cycles.

- Disease Spread: Estimating infection rates during an outbreak when patterns evolve rapidly.

- Technology Adoption Rates: Predicting smartphone usage as it tends to increase sharply before leveling off eventually.

By recognizing which type of extrapolation aligns with your data pattern, you can make more accurate forecasts and informed decisions.

Methods of Extrapolation

Extrapolation methods vary widely depending on the context and data type. Understanding these methods enhances your ability to make accurate predictions based on historical data.

Statistical Approaches

Statistical extrapolation involves mathematical techniques to extend trends in datasets. Common methods include:

- Linear Regression: This approach fits a straight line to past data points. For example, predicting next year’s sales from previous years’ growth.

- Moving Averages: This method smooths out fluctuations by averaging values over a specific period. It effectively forecasts future demand based on past sales volumes.

- Time Series Analysis: This technique analyzes temporal data trends, allowing you to predict future values based on seasonal patterns. An example includes predicting monthly electricity usage based on historical consumption.

Machine Learning Techniques

Machine learning offers advanced tools for extrapolation by leveraging algorithms that learn from data patterns. Notable techniques include:

- Decision Trees: This method splits data into branches for decision-making, helping predict outcomes like customer behavior based on historical purchase patterns.

- Neural Networks: These models mimic human brain functioning and excel at identifying complex relationships in large datasets. For instance, they can forecast stock prices using numerous influencing factors.

- Support Vector Machines (SVM): SVM classifies data into different categories while maximizing the margin between them, useful in categorizing economic indicators for future forecasting.

By utilizing both statistical approaches and machine learning techniques, you enhance your capacity for effective extrapolation across various fields and applications.

Applications of Extrapolation

Extrapolation finds diverse applications across various fields, allowing for informed predictions based on existing data. Here are some key areas where extrapolation proves valuable.

Scientific Research

In scientific research, extrapolation predicts outcomes from limited data sets. For instance, researchers may study a small sample of cells in a lab and extend those results to infer potential behaviors in larger populations. This approach aids in understanding complex phenomena, such as disease progression or drug efficacy.

Financial Forecasting

Financial forecasting relies heavily on extrapolation to predict market trends. Analysts analyze past stock prices and economic indicators to project future performance. Many financial models utilize historical growth rates to estimate future earnings or expenses. By applying these methods, investors can make better decisions regarding asset allocation and risk management.

Climate Modeling

Climate modeling employs extrapolation to forecast environmental changes over time. Scientists use historical climate data—like temperature patterns and CO2 levels—to predict future climate conditions. Such projections help policymakers understand potential impacts on ecosystems and human societies, driving discussions around sustainability initiatives and climate resilience strategies.

By leveraging extrapolation effectively across these sectors, professionals enhance their ability to make accurate predictions that inform strategic planning and decision-making processes.

Limitations and Challenges

Extrapolation presents several limitations and challenges that can affect the accuracy of predictions. Understanding these factors is crucial for effective application.

Assumptions in Extrapolation

Extrapolation relies on certain assumptions that may not always hold true. For instance, it presumes that past trends will continue into the future without significant changes. This assumption can lead to inaccuracies, especially in volatile markets or rapidly evolving fields. Additionally, extrapolating beyond a certain range increases uncertainty; data points become less reliable as they stray further from established trends.

Risks of Incorrect Extrapolation

Incorrect extrapolation poses serious risks across various sectors. For example:

- Financial Markets: Misjudging stock trends based on historical data can result in substantial losses for investors.

- Healthcare: Projecting patient needs inaccurately could strain resources and impact care quality.

- Climate Science: Erroneous climate predictions might undermine efforts to address environmental issues effectively.

Recognizing these risks helps you approach extrapolation with caution, ensuring better decision-making based on realistic expectations.