In the world of business, understanding your financial documents is crucial. Have you ever wondered what makes up the backbone of your accounting records? Examples of source documents include checks, sales invoices, receipts, and memorandums. These documents not only serve as proof of transactions but also play a vital role in maintaining accurate financial statements.

Each type of source document has its unique purpose and significance. For instance, checks are essential for tracking payments while sales invoices detail the products or services sold. Receipts provide evidence of purchases, and memorandums help in documenting important communications. By exploring these examples further, you’ll gain a clearer picture of how they contribute to effective record-keeping and financial management. Ready to dive deeper into the importance of these source documents?

Understanding Source Documents

Source documents are vital for accurate financial tracking. They consist of original records that capture transactions, providing the necessary details for bookkeeping and auditing.

Definition of Source Documents

Source documents refer to the original records that document business transactions. These can include checks, sales invoices, receipts, and memorandums. Each type plays a specific role in maintaining financial accuracy. For instance, a check serves as proof of payment while an invoice outlines goods or services provided.

Importance of Source Documents

Source documents are crucial for effective record-keeping and financial management. They provide evidence during audits and support tax reporting. Without these documents, businesses lack transparency in their finances. Moreover, they help resolve disputes by offering tangible proof of transactions. Tracking income and expenses accurately relies heavily on these essential records.

Examples of Source Documents

Source documents play a vital role in capturing business transactions. Here are some key examples:

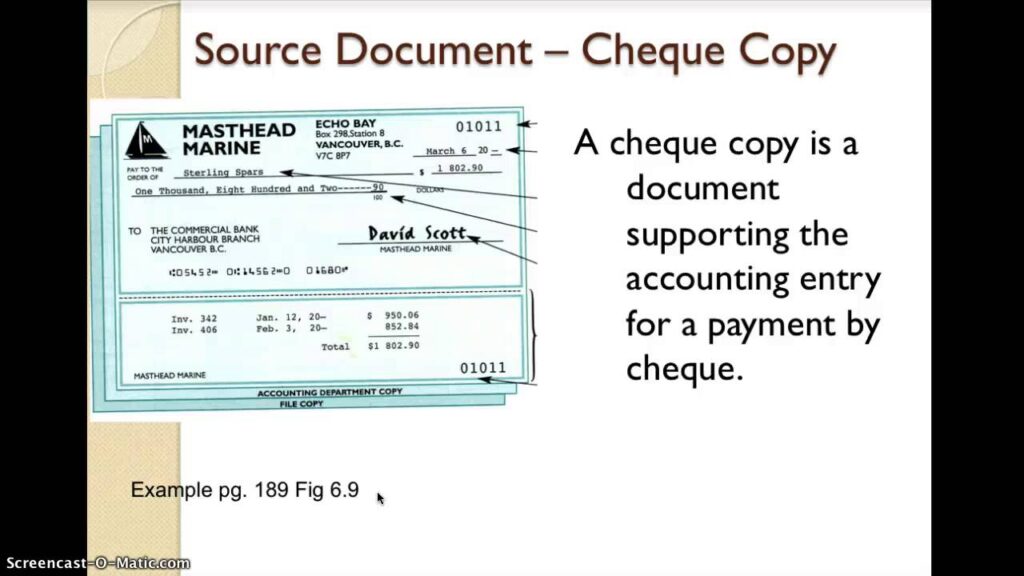

Checks

Checks serve as a direct form of payment for goods or services. They contain crucial details, such as the date, payee, amount, and signature. Checks provide proof of payment and help track expenses. Businesses often retain copies to maintain accurate accounting records.

Sales Invoices

Sales invoices detail the sale of products or services provided to customers. Each invoice typically includes information like item descriptions, quantities sold, prices, and total amounts due. Sales invoices act as formal requests for payment and essential records for accounts receivable. Keeping these documents is important for financial audits.

Receipts

Receipts confirm that a transaction has occurred between buyer and seller. They include data like purchase date, items bought, amounts paid, and payment methods. Receipts are valuable for tracking expenses and can be used during tax time. Retaining these documents helps businesses justify their expenditures.

Memorandums

Memorandums serve as internal communications within an organization. They may summarize meetings or outline decisions made by management. Memorandums ensure everyone stays informed about important updates. These documents also offer insight into decision-making processes when reviewing company history or conducting audits.

Functions of Source Documents

Source documents play a vital role in financial management. They ensure accurate record-keeping and provide proof of transactions, making them indispensable for businesses.

Record Keeping

Effective record keeping relies on source documents. These original records capture transaction details that help maintain organized financial statements. For instance:

- Checks document payments made, showing the date, payee, and amount.

- Sales invoices provide itemized lists of sold goods or services, including total amounts due.

- Receipts record purchases made by customers, detailing items bought and payment methods.

Each document serves as a reference point for tracking income and expenses accurately.

Evidence of Transactions

Source documents serve as evidence of transactions. They validate the legitimacy of business activities during audits or disputes. Consider how each type contributes:

- Checks verify payment to suppliers or employees.

- Sales invoices confirm sales agreements between businesses and clients.

- Receipts prove customer purchases for returns or exchanges.

When you keep these documents organized, you strengthen your financial integrity and support tax reporting efforts.

Best Practices for Using Source Documents

Using source documents effectively can significantly enhance your financial management. Organizing and storing these documents properly ensures easy access when needed.

Organization and Storage

Organize source documents systematically. Use folders or binders labeled by type, such as checks, invoices, receipts, and memorandums. Keeping them separated helps you quickly locate specific records during audits or tax preparation. Regularly review and purge unnecessary documents to maintain a clutter-free system.

Store physical copies in a secure location. Utilize fireproof safes or locked cabinets to protect against theft or damage. For digital files, employ cloud storage solutions with encryption to safeguard sensitive information.

Digital vs. Physical Copies

Both digital and physical copies serve essential roles in record-keeping systems. Digital copies offer convenience. You can easily back them up and share them with your accounting team without the risk of losing paper versions.

However, physical copies provide tangible proof. Some situations may require original documentation for legal purposes or verification processes. It’s wise to maintain both formats; use digitization tools like scanners to convert important physical documents into digital files while keeping originals safely stored.

Always ensure that whichever format you choose is organized according to your business needs for seamless access and management.