Understanding your financial statement is crucial for making informed decisions about your money. One key component you’ll encounter is liabilities, which represent what you owe. But what does that really mean? An example of a liability on your financial statement would be something as common as a loan or credit card debt, and recognizing these can help you assess your overall financial health.

Understanding Liabilities

Liabilities represent amounts you owe to others. Identifying these obligations is crucial for managing your finances effectively.

Definition of Liabilities

Liabilities are financial commitments that require repayment. Common examples include loans, credit card balances, and mortgages. You may also encounter accounts payable or accrued expenses in a business context. Each of these represents money that must be paid back at some point.

Importance in Financial Statements

Liabilities play a key role in assessing your financial health. They help determine your net worth by illustrating what you owe versus what you own. Understanding liabilities allows you to make informed decisions about spending, saving, and borrowing. Additionally, analyzing liabilities can highlight potential risks or areas where adjustments might improve your financial standing.

Types of Liabilities

Liabilities fall into two main categories: current liabilities and long-term liabilities. Understanding these types helps you assess your financial obligations accurately.

Current Liabilities

Current liabilities include debts due within one year. Common examples are:

- Accounts Payable: Money owed to suppliers for goods or services received.

- Credit Card Debt: Outstanding balances on credit cards requiring prompt payments.

- Short-Term Loans: Loans needing repayment within a year, such as personal loans.

- Accrued Expenses: Expenses incurred but not yet paid, like wages or taxes.

Recognizing these can help you manage cash flow effectively.

Long-Term Liabilities

Long-term liabilities represent debts due beyond one year. Examples include:

- Mortgages: Loans secured by real estate that require extended payment terms.

- Bonds Payable: Debt securities issued to investors with a fixed interest rate over time.

- Long-Term Leases: Lease obligations extending beyond one year, often for equipment or property.

- Student Loans: Educational loans needing repayment over several years.

Identifying these helps in planning future financial strategies.

An Example of a Liability on Your Financial Statement Would Be

Liabilities are essential to understand when evaluating your financial health. They represent amounts you owe, and recognizing them can guide your financial decisions.

Accounts Payable

Accounts payable is a common example of liabilities. This refers to the money owed to suppliers for goods or services received. For instance, if you run a business and purchase inventory on credit, that amount becomes part of your accounts payable. Regularly monitoring accounts payable helps manage cash flow effectively. You might also consider these factors:

- Payment terms

- Interest rates

- Supplier relationships

Long-Term Debt

Long-term debt encompasses loans due beyond one year. Mortgages are a prime example, as they typically extend over 15 to 30 years. Student loans also fall into this category and often require structured repayment plans. Understanding long-term debt is crucial since it impacts future budgeting and financial planning. Here are some key types:

- Mortgage loans

- Bonds payable

- Business loans

By recognizing these examples of liabilities, you can better assess your overall financial position and make informed choices about spending, saving, and investing.

Implications of Liabilities on Financial Health

Liabilities significantly influence your financial health. They represent what you owe and play a key role in evaluating your overall financial stability. Understanding their implications helps in making informed choices.

Impact on Creditworthiness

Liabilities directly affect your creditworthiness. Lenders assess your debt-to-income ratio, which compares monthly debt payments to gross income. A high ratio may signal financial strain, leading to lower credit scores. For example:

- Credit card balances: High outstanding amounts can reduce your score.

- Student loans: These long-term debts factor into evaluations.

- Mortgages: Outstanding mortgage balances also impact perceptions of risk.

Maintaining manageable liability levels enhances your ability to secure favorable loan terms.

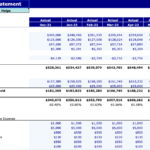

Importance in Financial Analysis

Liabilities are crucial for accurate financial analysis. They help determine net worth by subtracting total liabilities from total assets. This calculation provides insight into financial health and future planning. Key aspects include:

- Current liabilities: Monitor these for short-term cash flow management.

- Long-term liabilities: Assess how they fit into long-term budgets and investment strategies.

Regularly reviewing liabilities allows you to identify trends or potential issues before they escalate, ensuring better control over your finances.