Understanding the intricacies of accounting can feel overwhelming, but it doesn’t have to be. Examples of accounting policies provide clarity and guidance for businesses navigating financial reporting. These policies are essential as they dictate how a company recognizes revenue, values assets, and manages expenses.

Ever wondered how different companies handle their finances? By examining various accounting policy examples, you’ll gain insights into best practices that enhance transparency and compliance. From inventory valuation methods to revenue recognition standards, these examples illustrate the diverse approaches organizations take in their financial dealings.

Overview of Accounting Policies

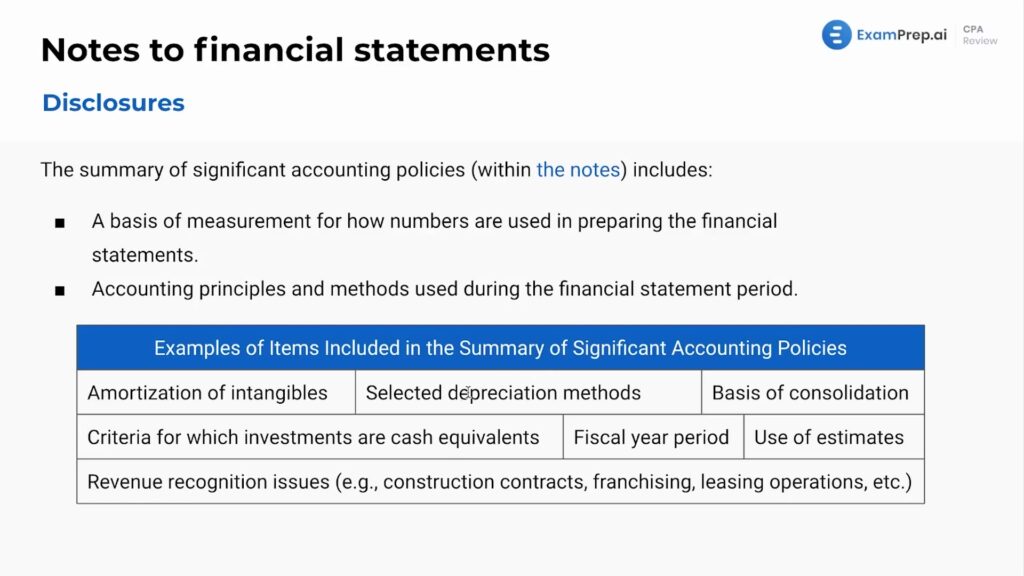

Accounting policies establish the framework for how financial transactions are recorded and reported. These policies ensure consistency, transparency, and compliance with regulatory requirements. Different businesses adopt various accounting policies based on their operational needs and relevant accounting standards.

Here are some common examples of accounting policies:

- Revenue Recognition Policy: This policy outlines when revenue is recognized in the financial statements. For instance, a company might recognize revenue at the point of sale or upon delivery of goods.

- Inventory Valuation Method: Businesses choose methods like FIFO (First In, First Out) or LIFO (Last In, First Out) to value inventory. This choice can significantly affect financial outcomes.

- Depreciation Methods: Companies select depreciation methods such as straight-line or declining balance to allocate the cost of tangible assets over time. Each method impacts profit reporting differently.

- Expense Recognition Policy: This policy dictates when expenses are recorded in relation to revenue generation. Matching expenses to revenues enhances accuracy in financial reporting.

Understanding these examples helps you appreciate how they influence overall business performance and decision-making processes.

Importance of Accounting Policies

Accounting policies play a crucial role in financial management. They guide your organization in consistent and transparent reporting. Strong accounting policies enhance decision-making processes, ensuring that stakeholders understand the financial health of your business.

Enhancing Financial Reporting

Clear accounting policies improve the quality of financial reports. These policies dictate how transactions are recorded, which directly impacts the accuracy of your financial statements. For instance, if you use FIFO (First-In, First-Out) for inventory valuation, it reflects a more accurate cost flow during inflationary periods compared to LIFO (Last-In, First-Out). Such clarity helps investors and regulators accurately assess performance.

Ensuring Compliance

Accounting policies ensure adherence to legal regulations and standards. By following established frameworks like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), you mitigate risks associated with non-compliance. This can prevent potential audits or penalties that arise from discrepancies in reporting practices. Regularly reviewing these policies ensures they align with updated laws and standards, keeping your organization compliant and trustworthy.

Common Types of Accounting Policies

Understanding common types of accounting policies helps you navigate financial reporting effectively. These policies guide how businesses recognize revenue, value inventory, and calculate depreciation.

Revenue Recognition Policies

Revenue recognition policies determine when and how a company recognizes its income. For example:

- Sales-based Recognition: Recognize revenue at the point of sale.

- Percentage-of-Completion: Recognize revenue based on the progress of long-term contracts.

- Completed Contract Method: Delay revenue recognition until project completion.

These methods can significantly impact reported earnings. You might notice that different industries often adopt specific approaches for consistency.

Inventory Valuation Policies

Inventory valuation policies dictate how companies assess the value of their unsold inventory. Common examples include:

- First-In, First-Out (FIFO): Assumes oldest inventory is sold first.

- Last-In, First-Out (LIFO): Assumes newest inventory is sold first.

- Weighted Average Cost: Averages out costs for all items in stock.

The chosen method affects gross profit and tax liabilities. Consider that fluctuations in market prices can lead to differing financial outcomes depending on which method you use.

Depreciation Methods

Depreciation methods outline how businesses allocate the cost of tangible assets over time. Some popular methods are:

- Straight-Line Depreciation: Spreads asset cost evenly over its useful life.

- Declining Balance Method: Accelerates depreciation in early years.

- Units of Production Method: Bases depreciation on actual usage or output.

Your choice here influences net income and tax expenses. It’s crucial to select a method that aligns with your business strategy while adhering to relevant regulations.

Real-World Accounting Policies Examples

Understanding real-world applications of accounting policies helps you grasp their significance. Here are notable examples showcasing how businesses implement these principles.

Case Study: Revenue Recognition in Software Companies

Software companies often utilize the percentage-of-completion method for revenue recognition. This approach allows them to recognize revenue as they progress through a software development project. For instance, if a company estimates that 60% of a project’s work is complete, it can record 60% of total contract revenue at that point. Additionally, some companies might opt for the completed contract method, recognizing all revenue only when a project is fully finished. This decision impacts cash flow projections and earnings reports significantly.

Case Study: Inventory Valuation in Retail

Retail businesses frequently adopt different inventory valuation methods, like FIFO (First-In, First-Out) and LIFO (Last-In, First-Out). With FIFO, older inventory costs are assigned to cost of goods sold first; this method reflects current market conditions better during inflationary periods. Conversely, LIFO matches newer costs against revenues, which can lower taxable income during high inflation but may not accurately represent actual inventory flows.

Consider these points:

- FIFO results in higher profits in rising price environments.

- LIFO offers tax advantages but may understate ending inventory value.

- Both methods affect financial ratios used by investors and creditors differently.

These examples illustrate how specific accounting policies directly influence financial outcomes and overall business performance.

Best Practices for Developing Accounting Policies

Establishing effective accounting policies requires careful consideration. Start by conducting a thorough review of existing regulations and industry standards. This ensures compliance while aligning your policies with best practices.

- Document Policies Clearly: Ensure each policy is written in clear, concise language. Everyone involved should understand the guidelines without ambiguity.

- Involve Stakeholders: Engage key stakeholders in the development process. Their insights can help identify potential issues and enhance policy effectiveness.

- Regularly Review Policies: Schedule periodic reviews of your accounting policies to adapt to regulatory changes or business dynamics. Staying updated prevents non-compliance risks.

- Train Employees: Provide training sessions on your accounting policies for all relevant personnel. This builds understanding and encourages adherence to established protocols.

- Implement Technology Solutions: Utilize software that supports compliance and reporting requirements effectively, enhancing accuracy.

- Conduct Impact Assessments: Analyze how proposed changes might affect financial statements before implementation. Understanding potential implications allows informed decision-making.

By following these best practices, you create a robust framework that supports accurate financial reporting and compliance with legal standards while promoting transparency within your organization.