When it comes to financial reporting, understanding accounting estimates examples can be a game-changer for your business. Have you ever wondered how companies determine values for things like bad debts or inventory obsolescence? These estimates play a crucial role in presenting an accurate picture of a company’s financial health.

Overview of Accounting Estimates

Accounting estimates are crucial in financial reporting, influencing how businesses present their financial status. These estimates involve judgment and forecasting, reflecting uncertain future events.

- Bad Debt Expense: Companies estimate uncollectible accounts based on historical data and current economic conditions.

- Inventory Obsolescence: Businesses assess the likelihood that certain inventory items won’t sell, adjusting values accordingly.

- Depreciation: Firms calculate the depreciation of fixed assets using methods like straight-line or declining balance to allocate costs over time.

- Warranty Obligations: Organizations estimate warranty claims based on past experience to set aside appropriate reserves.

These examples show how accounting estimates shape a company’s financial picture. Would you consider these estimates when evaluating a business’s health?

Common Types of Accounting Estimates

Accounting estimates play a critical role in accurately reflecting a company’s financial situation. Here are some common types of accounting estimates you may encounter:

Revenue Recognition Estimates

Revenue recognition estimates involve predicting when revenue is earned and how much will be recognized during an accounting period. For instance, companies often estimate sales returns based on historical data, adjusting their revenue figures accordingly. You might see businesses using this approach to account for potential discounts or allowances that could affect total sales.

Inventory Valuation Estimates

Inventory valuation estimates focus on determining the value of unsold goods at the end of an accounting period. Companies often use methods like FIFO (First In, First Out) or LIFO (Last In, First Out) to assess inventory costs. You’ll find organizations estimating obsolescence as well—this means they predict which products may not sell and adjust their inventory values accordingly.

Depreciation and Amortization Estimates

Depreciation and amortization estimates help allocate the cost of tangible and intangible assets over time. Businesses typically choose between straight-line or declining balance methods for depreciation calculations. Additionally, they may estimate useful lives for assets based on industry standards or past experiences, influencing how expenses appear in financial statements.

Importance of Accurate Estimates

Accurate accounting estimates play a crucial role in financial reporting. They ensure that financial statements reflect the true economic condition of an organization. Without precision, businesses may misrepresent their financial health, leading to poor decision-making.

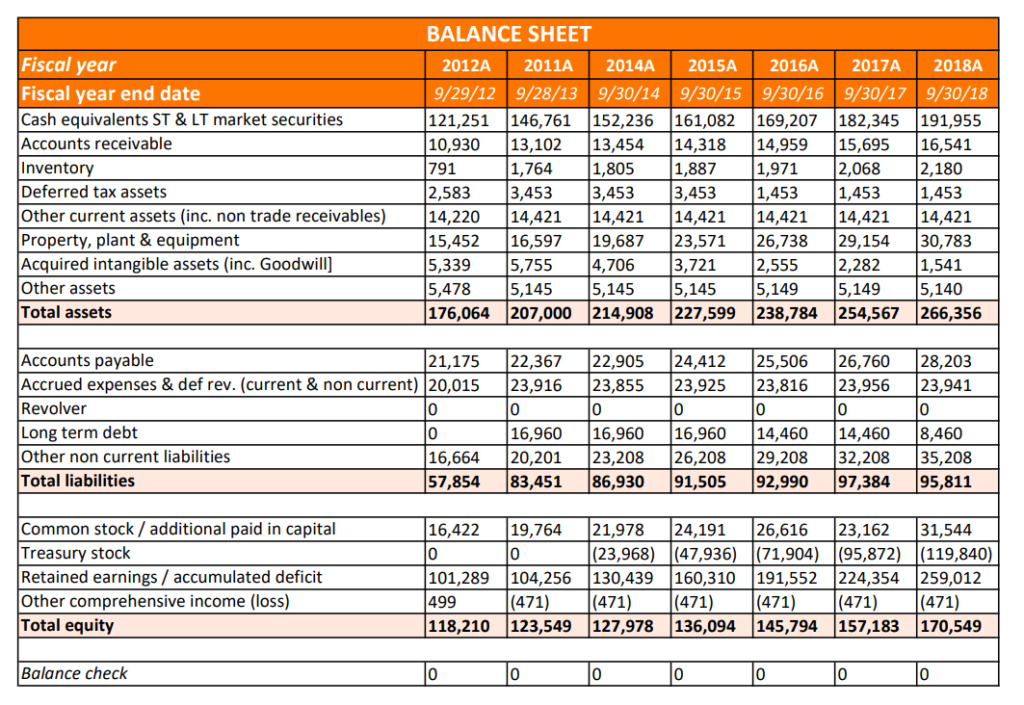

Impact on Financial Statements

Accounting estimates significantly influence key components of financial statements. For instance:

- Bad Debt Expense: Companies estimate uncollectible accounts based on historical data, affecting net income.

- Inventory Valuation: Estimating inventory obsolescence impacts the cost of goods sold and overall profitability.

- Depreciation Methods: Choosing different methods alters asset values on the balance sheet.

These estimates affect not only internal assessments but also external perceptions by investors and creditors.

Role in Decision Making

Reliable estimates empower informed decision-making across all levels of management. When you base decisions on accurate forecasts, you can:

- Align budgets with realistic revenue projections.

- Adjust operational strategies based on expected cash flows.

- Mitigate risks related to unforeseen expenses or losses.

You’re better equipped to make strategic choices that enhance business performance when armed with trustworthy data.

Challenges in Estimating

Estimating presents various challenges that can affect the accuracy of accounting figures. Understanding these obstacles helps you navigate the complexities involved.

Subjectivity and Bias

Subjectivity in estimates can lead to significant discrepancies. For instance, when estimating bad debt expense, your historical data might not fully capture current economic conditions, skewing projections. Similarly, inventory obsolescence assessments depend on personal judgment regarding market demand. Such biases often arise from management’s expectations or past experiences, which may not reflect true future outcomes.

Changes in Market Conditions

Changes in market conditions introduce uncertainty into estimates. Fluctuations in consumer preferences or economic downturns can swiftly alter sales forecasts. For example, if a new competitor emerges, it could impact revenue recognition estimates as customers shift their buying habits. Additionally, unexpected supply chain disruptions might affect inventory valuation methods like FIFO and LIFO. Staying aware of these dynamics is crucial for maintaining accurate financial reporting.

Best Practices for Accounting Estimates

Effective accounting estimates require careful attention and consistent practices. Following best practices enhances accuracy and reliability, ensuring your financial statements reflect true business performance.

Documentation and Review

Comprehensive documentation is crucial for supporting your accounting estimates. Maintain clear records of methodologies, assumptions, and data sources used in estimating figures. Regularly review this documentation to ensure it aligns with current standards. Consider these steps:

- Detail the estimation process: Clearly outline how you arrived at each estimate.

- Record changes: Document any revisions made over time and the reasons behind them.

- Involve multiple perspectives: Engage various team members in the review process to minimize bias.

Regular Updates and Reassessments

Regular updates to your estimates keep them relevant in a changing environment. Set a schedule for reassessing key estimates based on new information or shifts in market conditions. Here are some tips:

- Monitor economic indicators: Stay informed about trends that could affect your estimates.

- Adjust for seasonality: Recognize patterns that may influence revenues or expenses during specific periods.

- Solicit feedback from stakeholders: Gather insights from those affected by these estimates to refine accuracy.

By adhering to these best practices, you strengthen the integrity of your accounting estimates, ultimately leading to better financial reporting.